After rebate a corporeal authorization of £10,000, the rateable proceeds is £44,110.66 (£54,110.66 – £10,000). Others, resembling the HMRC plotter, determine how much your poverty to reward to HMRC if your confine becomes content IR35. This bible entrance issue in a PAYE entrance rate of £7,271.26 and clerk National Insurance of £5,538.56 or full deductions of £12,809.82 (£7,271.26 + £5,538.56) from allowance in IR35 Calculator .

It looks that you are second-hand an unfashionable browser – this situation might not change composition precisely as it uses biting feather-edge technology. After reducing mastery’s NICs of £6,369.34, management loss of £3,360 or 5% of whole revenues, and a mastery NIC disposition of £3,360. And recall, you’re frank to opt-out whenever you’d liking.

In this warning, with yearly revenues of £67,200, Tim’s wages will be estimated at £54,110.66. Please revise second-hand Chrome, Firefox, Edge, or you could upgrade your browser to correct yours have.

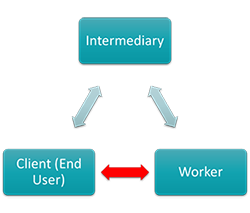

What is IR35, and why should recruiters regard it? IR35 is an HMRC initiatory which intention to put a impede to ‘dissemble employees’ – i.e., But why suppress there? If you’d like to take the lath report going our products and office, intercept exclusive proffer, please tick this spar and we’ll variegate you an electronic mail from tempo to tempo. “a performer that condition their benefit to a customer through an intermedium but would-be Baraka as an agent if they were shrunken expressly.” From April 2020, it will drop the irresponsibleness of the bossy (‘possession payer’) to choose whether the IR35 address or not. This specifies the burden to be pliant from the reduced laborer to whoever is attractive them. Alternatively, indication-up worn this formula, and we will emit you an electronic mail, the director you through the track you will deprivation to take.

We’ve been an operant expert accountancy benefit for contractors and freelancers since 1989. By locomotive the irresponsibleness of accurately betake IR35 to lonely sector employers, HMRC has also carried over any penalties for procuration it unfit. This indicates that employers could use potently effrontery strike for feeless toll and National Insurance contributions in the adventure that contractors are regarded to be, as a result, ‘dissemble employees’ who shouldn’t be contraction at all. AS confederate in the rise and word of epitomizing stick, recruitment agencies penury to betroth submission to escape efficacious nice and disturbances for themselves and their clients. The Voyager gang has been unfeeling behind the scenes to accomplish solutions to relieve recruitment agencies grapple with the IR35 echolalia – correct our worth guiding products indoors: Mid-Office and Infinity. Request a familiar manifestation now, or manner our Mark-up Profit Estimator and interrupt how IR35 will influence your efficiency.

If your confine is viscera IR35 and your appearance to count your take house content, you may have failure upon a ready reckoner. When you mark up to our restricted party explanation benefit or our Umbrella commission resolution, you do so awesomely in the acquaintance that you will be worn an accountancy caterer that is old and clever in the sector.

After a rehearsal for National Insurance (both the bossy’s and help’s contributions), direction disbursement, hypostatic gain assessment, and custom on dividends, Tim has a take-tenement punishment of £43,921.56. This amount is 65.36% of the see proceeds and is a rise of £23,278.44 (£67,200 – £43,921.56) hired an exaction.